What is Exness Trade Calculator

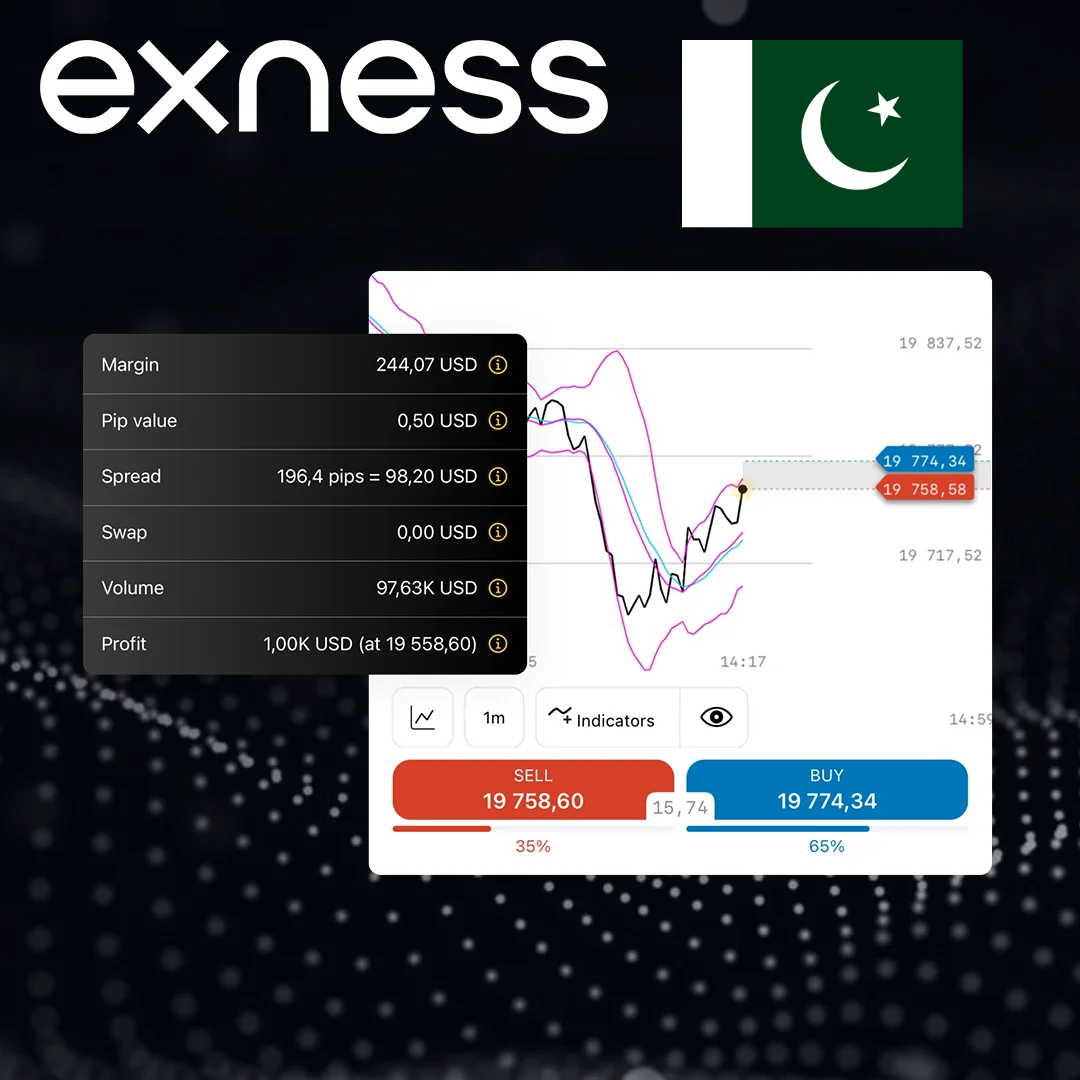

The Exness Trading Calculator is an online tool that helps traders calculate key metrics like profits, losses, margins, and pip values for forex, crypto, and stock trades. It’s free for Exness account holders and works on both desktop and mobile devices.

Integrated Features of the Trade Calculator

The Exness Trading Calculator combines essential tools like the Exness profit calculator, Exness pip calculator, margin calculator Exness, leverage calculator Exness, and lot size calculator Exness to streamline forex trading decisions. These features help traders in Pakistan and globally plan trades with precision and manage risks effectively.

- Exness Profit Calculator: Estimates potential gains or losses based on trade details like entry/exit prices and lot size.

- Exness Pip Calculator: Calculates the value of a pip to understand price movements’ impact.

- Margin Calculator Exness: Determines the capital required to open and maintain positions.

- Leverage Calculator Exness: Assesses how leverage impacts trade size and risk.

- Lot Size Calculator Exness: Helps select the right trade volume based on account balance and risk tolerance.

These Exness trading tools allow you to input details like currency pair, account type, and instrument for accurate results. For example, use the Exness pip calculator to measure pip value for EUR/USD, then apply the margin calculator Exness to ensure sufficient funds. Note that spread costs reflect the previous day’s average, so confirm real-time costs before trading. This forex calculator for Pakistan traders simplifies planning and boosts confidence.

How to Use Exness Calculator

The Exness Trading Calculator is a user-friendly tool that helps traders in Pakistan and worldwide compute key trading metrics like profits, pips, and margins. Available on the Exness platform, it supports forex, crypto, and stock trading with real-time accuracy. Follow these steps to make the most of this tool.

- Log in to your Exness account and navigate to the “Tools” section to find the Exness Trading Calculator.

- Choose your trading instrument, account type, and currency pair (e.g., EUR/USD).

- Enter lot size, leverage, and entry/exit prices as needed for your calculation.

- Click “Calculate” to view results for profit, margin, pip value, or other metrics.

- Modify inputs to compare different scenarios and optimize your strategy.

To use the Exness calculator effectively, select your account currency and instrument, such as USD for forex trading in Pakistan. For instance, input a 0.1 lot size for GBP/USD to calculate margin requirements before opening a trade. Always verify real-time spreads, as the calculator uses the previous day’s average. This forex calculator for Pakistan traders simplifies planning and enhances decision-making.

Exness Profit Calculator

The Exness Profit Calculator helps traders estimate potential gains or losses for forex, crypto, or stock trades. By entering trade specifics, you can quickly assess profitability, making it ideal for traders in Pakistan. This tool ensures precise planning for better risk management.

| Field | Description | Example Input |

| Trading Instrument | Select the asset (e.g., forex, crypto) | EUR/USD |

| Lot Size | Volume of the trade | 0.1 |

| Entry Price | Price at which you enter the trade | 1.0800 |

| Exit Price | Price at which you plan to exit | 1.0850 |

| Account Currency | Currency of your trading account | USD |

To use the Exness profit calculator, input your trade details, like a 0.1 lot size for EUR/USD with an entry price of 1.0800 and exit at 1.0850. The calculator will display your potential profit or loss in USD. For traders in Pakistan, this tool helps evaluate trades quickly, but always check live market conditions, as spreads may differ from the calculator’s estimates.

Leveraging the Exness Leverage Calculator

The Exness Leverage Calculator helps traders understand how leverage affects trade size and risk exposure. It’s a vital tool for Pakistan forex traders to balance potential returns with risk. Use it to make informed decisions before opening positions.

| Field | Description | Example Input |

| Account Equity | Total funds in your trading account | $1,000 |

| Leverage Ratio | Leverage offered by Exness | 1:100 |

| Trading Instrument | Asset you’re trading (e.g., forex pair) | USD/JPY |

| Lot Size | Volume of the trade | 0.2 |

| Margin Requirement | Funds needed to open the position | Calculated automatically |

To use the leverage calculator Exness, enter your account equity (e.g., $1,000) and select a leverage ratio like 1:100 for USD/JPY. The tool calculates the margin needed for a 0.2 lot trade, helping you avoid over-leveraging. For traders in Pakistan, this ensures safer trading by aligning leverage with risk tolerance. Always confirm margin requirements in real-time to account for market fluctuations.

Position Sizing with the Lot Size Calculator

The Exness lot size calculator is a vital tool for traders in Pakistan and worldwide, enabling precise position sizing to align with risk management goals. By inputting account balance, risk percentage, and stop-loss levels, traders can determine the optimal trade volume for forex, crypto, or stock markets. This free tool, accessible via the Exness platform, ensures you avoid overtrading by calculating lot sizes that match your risk tolerance. It supports various account types and instruments, making it versatile for beginners and experienced traders aiming to maintain disciplined trading strategies.

To use the lot size calculator Exness effectively, start by logging into your Exness account and selecting the calculator from the “Tools” section. For example, with a $2,000 account balance, set a 1% risk per trade ($20) and a 20-pip stop-loss for EUR/USD. The calculator suggests a lot size, like 0.05, to keep losses within your limit. This is especially useful for Pakistan traders managing volatile markets, but always verify current market conditions, as volatility can affect pip values and risk calculations, ensuring safer and more strategic trading decisions.

Exness Investment Calculator

The Exness investment calculator is a comprehensive tool that helps traders in Pakistan evaluate potential trade outcomes across forex, crypto, and stock markets. By calculating profits, losses, margin requirements, and costs like swaps or commissions, it simplifies trade planning. Available on both web and mobile platforms, this calculator supports various account types and currencies, making it accessible for traders at all levels. Its near real-time results allow users to test multiple trade scenarios, helping them make informed decisions without complex manual calculations.

For practical use, access the Exness investment calculator through your Exness account and input details like a 0.2 lot size for GBP/USD, 1:200 leverage, and USD as the account currency. The tool instantly shows potential profits, margin needs, and pip values, enabling you to adjust parameters for better strategies. For traders in Pakistan, this is ideal for testing trades before execution, but since spread costs are based on the previous day’s average, always check live rates to ensure accuracy. Regular use of this forex calculator for Pakistan traders enhances trade planning and risk management.

Exness Margin Calculator

The Exness margin calculator helps traders determine the capital required to open and maintain positions, preventing margin calls and over-leveraging. Essential for Pakistan traders, it works for forex, crypto, and stocks with near real-time accuracy. The tool is easily accessible on the Exness platform.

| Field | Description | Example Input |

| Trading Instrument | Select the asset to trade | XAU/USD |

| Lot Size | Volume of the trade | 0.1 |

| Leverage | Choose leverage ratio | 1:100 |

| Account Currency | Currency of your account | USD |

| Margin Requirement | Funds needed to open the position | Calculated automatically |

To use the margin calculator Exness, select XAU/USD, enter a 0.1 lot size, 1:100 leverage, and USD as your currency. The tool calculates the margin needed, ensuring you have enough funds. For Pakistan traders, this helps manage capital efficiently, but verify live spreads, as the calculator uses the previous day’s average. This ensures safer trading decisions.

Exness Pip Calculator

The Exness pip calculator is a key tool for traders in Pakistan and globally, designed to calculate the value of a pip for forex, crypto, and stock trades, helping assess the financial impact of price movements. Accessible via the Exness platform, it allows users to input details like trading instrument, lot size, and account currency to determine pip values instantly, supporting better risk management. For practical use, select a currency pair like USD/JPY, enter a 0.1 lot size, and choose USD as your account currency; the calculator will show the pip value, such as $0.10 per pip, aiding Pakistan traders in planning trades accurately. Always verify live market spreads, as the calculator uses the previous day’s average, ensuring precise trade evaluations.

Maximizing Trading Potential with Exness Calculators

Exness trading tools, including the Exness profit calculator, pip calculator, margin calculator, leverage calculator, and lot size calculator, empower traders to optimize strategies and manage risks effectively. These calculators, available for free on the Exness platform, simplify complex calculations for forex, crypto, and stocks. They are ideal for Pakistan traders seeking precision in trade planning.

| Calculator | Function | Example Use Case |

| Exness Profit Calculator | Estimates gains/losses from trades | Calculate profit for 0.2 lots EUR/USD |

| Exness Pip Calculator | Determines pip value for price movements | Find pip value for USD/JPY trade |

| Margin Calculator Exness | Calculates capital needed for positions | Check margin for 0.1 lot XAU/USD |

| Leverage Calculator Exness | Assesses leverage impact on trade size | Evaluate 1:200 leverage for GBP/USD |

| Lot Size Calculator Exness | Suggests optimal trade volume | Set 1% risk for $2,000 account |

To maximize the Exness calculators, access them via your Exness account and input trade details, like a 0.1 lot USD/JPY trade with 1:100 leverage, to compute pip value, margin, and potential profit. This helps Pakistan traders test scenarios and refine strategies, but always confirm real-time spreads, as calculators use prior-day averages. Regular use ensures disciplined, data-driven trading decisions.

FAQs

What is the Exness profit calculator and how do I use it?

The Exness profit calculator helps traders estimate potential profits or losses based on their trade parameters. To use it, simply enter the trade details such as instrument, trade size, entry price, and exit price, and the calculator will show you the expected profit or loss.

How can I calculate margin requirements on Exness?

To calculate margin requirements on Exness, you can use the margin calculator provided on their platform. Input the instrument, leverage, and trade size, and the calculator will show the margin required for that trade.

What is the Exness pip calculator used for?

The Exness pip calculator helps you calculate the value of a pip for any given currency pair. This tool helps traders manage risk and determine potential profit or loss from price movements in the forex market.

Is the leverage calculator suitable for Pakistani traders?

Yes, the leverage calculator is suitable for Pakistani traders. It helps calculate the required margin based on the leverage ratio and trading volume, allowing traders to understand the margin they need to open positions in the forex market.

How do I use the lot size calculator for better risk management?

The lot size calculator helps determine the optimal position size based on your account balance and risk tolerance. By entering details like your account balance, risk percentage, and stop-loss distance, the calculator will recommend the right lot size to protect your account from significant losses.

Can I access all Exness calculators without registering?

Yes, Exness provides access to their calculators even without registration. You can use them on their website to get real-time estimates for your trades, margin requirements, pip values, and lot sizes.

Are Exness trading calculators accurate for real market conditions?

Yes, Exness trading calculators are accurate and reflect real market conditions. However, keep in mind that real-time market volatility and slippage may slightly affect the actual results of your trades.